Struggling With MCA - Business Loans,

Can't Make Payroll?

- Flexible repayment options without taking additional funds

- Free up cash flow immediately and see the savings instantly

- Included legal representation with real attorneys throughout the program

- Fast easy secure signup

How We Can Help?

Reduce Your

MCA Payments

Up To 60% Today

with Debtifi

At Debtifi, we specialize in helping businesses regain financial stability by reducing MCA payments. Backed by over 50 years of combined expertise, our leadership team has successfully guided thousands of business owners through financial challenges. We offer tailored solutions to restructure your MCA, lower your payments, and provide the financial relief needed to keep your business thriving.

Navigating Financial Stability and Success

Comprehensive Business Debt Solutions

Business Debt Analysis

Business Loan Modification

Debt Consolidation Solutions

Debt Management Services

Debt Negotiation Assistance

Full Legal Representation

Preparing For

Your Financial Well-Being

We helped save over

in debt for the Transportation Industry

We helped save over

in debt for the Construction & Real Estate Industry

We helped save over

in debt for the Food Service Industry

We helped save over

in debt for the Healthcare & Medical Industry

At Debtifi, our priority is your business’s success. We work for you—not your lenders—to ensure financial stability and growth. With years of expertise and strong industry relationships, we’ve successfully restructured millions in corporate debt, using proven strategies to ease your financial burden and keep your business thriving.

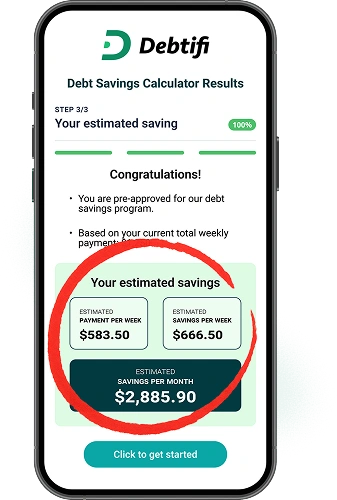

Find Out How Much You Can Save In 60 Seconds?

Find out how quickly you can

reduce your MCA payments

with our free calculator.

Find Out How Much You Can Save In 60 Seconds?

Find Out How Much You Can Save In 60 Seconds?

Find out how quickly you can

reduce your MCA payments

with our free calculator.

What Customers Say

Our Success Stories

Trusted & Approved As Seen On TV

Credit Spotlight

Business Bankruptcy

Debtifi specializes in helping businesses struggling with unsecured debts and at risk of bankruptcy. Our experienced team of experts can work with you to restructure your finances and avoid liquidation.

Through our services, we can help you by providing the financial relief your business needs to get back on track. Reduce your Merchant Cash Advance payments by up to 80% and regain control over your business finances. Don’t let predatory loans like merchant cash advances ruin your business.

FAQ

Your Questions ANSWERED

Contact Us

Ready to Get Started?

Disclaimer: Please be advised that all communications with the Company, including phone calls, may be recorded or monitored for quality assurance, training, and compliance purposes.

All claims and results referenced are based on enrolled debts. Please note that not all debts are eligible for enrollment, and not all clients complete our program due to various factors, including, but not limited to, their inability to accumulate sufficient funds for settlement. Outcomes and estimates provided are derived from historical results, which may vary significantly depending on individual circumstances. The Company does not guarantee specific reductions in debt amounts or percentages, nor does it guarantee that clients will become debt-free within a predetermined timeframe. The Company does not assume responsibility for your debts, make monthly payments to creditors, or provide services related to tax, bankruptcy, accounting, legal advice, or credit repair. Our services may not be available in all states. We strongly recommend consulting a qualified tax professional to evaluate any potential tax implications of debt settlement. Additionally, for information regarding bankruptcy, we advise consulting a licensed bankruptcy attorney.

Prior to enrolling in any program, please thoroughly review and understand all program materials, including the potential adverse effects on your credit rating. The Company and its affiliates are not lenders, creditors, or debt collectors. This program does not constitute a loan. Testimonials reflect the experiences and opinions of individual clients and are not necessarily representative of all experiences with the Company or its affiliates. Results may vary. We collect certain information automatically when you visit our website, including your IP address, browser type, and pages visited. This data is used for analytics and security purposes.